191 results found

-

How can I get a replacement for a broken or damaged debit card?

To order a replacement for a damaged debit card, call Client Care at 1-800-731-2265 or visit any banking center.

The normal timeframe for delivery is 7-10 business days. To receive a card sooner, you can instead choose to pay a $35 fee and receive the replacement card in two business days. The card must be ordered by 4pm on any business day for it to be delivered in two business days.

A Lost or Stolen Debit Card

If instead of a damaged debit card you need help with a lost or stolen card, please call us at 1-800-731-2265, option 2, in the US. You can report a lost or stolen card 24-hours a day. If you are outside of the US, call 1-812-422-2197. We can cancel or restrict your card, check for unauthorized transactions and order a new card for you. -

Where should I send a notice of error or request for information about my loan?

Please mail all notices of error or requests for information about your Old National loan to:

Old National Bank

Attn: Client Success

P.O. Box 143

Evansville, IN 47701 -

Why is my request for Digital Banking access showing as declined or pending?

When you complete the Digital Banking enrollment process, we must verify the information you provide in order to prevent any unauthorized access to your account. The security of client information is one of our highest priorities. If your request for Digital Banking has been declined, it most likely means we were not able to successfully verify the information you provided during the enrollment process. A pending status most likely means we are working to verify your information. We will email you to notify you when your Digital Banking enrollment request is approved or declined.

If you have questions or concerns about your Digital Banking enrollment, please call Client Care at 1-800-731-2265, and one of our associates would be happy to assist you.

-

Where can I find my Old National checking or savings account number?

Within Online Banking, your full account number can be found through the following steps:

- After you log in to Online Banking, click on the account name for which you want an account number. Please remember that your account number will be different for each account.

- Clicking on the account name will take you to the Account History page. On this page, click on Account Details to reveal more information about your account. Your full account number is the ACH number.

- On the bottom right of the account details, you can print your account detail information or click the X to close the account details.

You can also find your full checking number in the following ways:

- On a mailed statement or eStatement within Online Banking. Your account number is on the upper right corner of the statement.

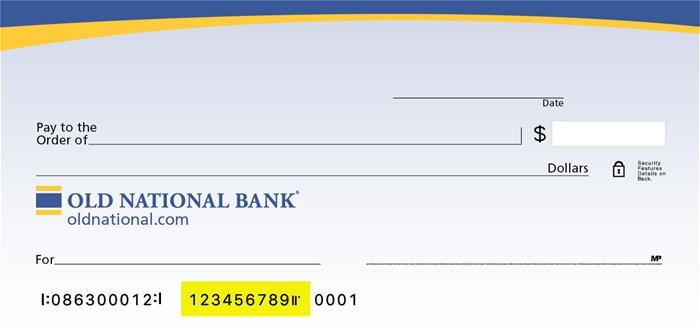

- At the bottom of a physical check or the bottom of a check image within Online Banking. You will see three sets of numbers at the bottom of the check. Your account number is the center set of 7-10 numbers. (Note that the set of numbers on the left, 086300012, is the Old National routing number.)

Visit any Old National banking center for assistance.

-

How do I change the address, phone number or email address on my account?

To change your mailing address, Old National offers several options:

- Please call 800-731-2265 Monday – Friday 7am to 6pm CST or on Saturday from 7am till noon CST.

- You may visit any Old National banking center and provide an updated photo ID or utility bill that contains the new address.

- Download a Personal Address Change Form or Business Address Change Form that you can mail to Old National.

To change your phone number or email address:

- Within Online Banking, go to My Settings and click Edit next to either your phone number or email address to update this information.

- You may also visit any Old National banking center or call Client Care at 1-800-731-2265.

Please note that changes can only be applied to the information for the person requesting the change. If there are additional people listed on the account, those individuals will need to request updates for their own information.

-

What should I do if I forgot my User ID or Password for Digital Banking?

Your user ID and Password for Digital Banking and the Mobile App are the same. If you have forgotten your User ID and Password, you can do one of the following:

- On a computer or other device, go to the home page. Go to the blue Login box on the upper right side of the page. Click on Forgot User ID or Password. You will be asked to provide information to receive a temporary password or click I forgot my user id.

- If you are using the Mobile App, on the Login screen, tap Forgot Login. Enter the requested information to receive a temporary password or tap I forgot my user id.

- If, after trying the above, you are not able to retrieve or reset your password, please call Client Care at 1-800-731-2265, Option 3, for login assistance.

Please note, when requesting or resetting your User ID or Password, you will be asked to enter your email or phone number. For security purposes, the email or phone number must match the email or phone number you have provided for your account. Additionally, resetting your User ID or Password disables your biometrics. To enable, within your app navigate to "More" and access your settings.

-

How can I find a certain Old National banking center or ATM?

There are several ways to find an Old National banking center or ATM through our website and our Mobile App:

On the website

Visit oldnational.com/locations to go to our Branch & ATM locator page. Enter the following information into the Search box.- To find a specific location, including hours, enter address (as much as you know), city and state of the location you are searching for. Select Search.

- To find the banking center or ATM closest to your current location, enter your location and choose Search. A listing of your nearest banking centers and ATMs will be provided. You can also choose to Get Directions.

In the Mobile App

- Open the App on your device. You do not have to log in. At the bottom of the Login screen, select Locations. You can use the Search at the top of the screen to find a branch or ATM by address, zip code or city.

- If you are already logged in to the Mobile App, go to More at the bottom right of the screen and then Locations under Contact Us.

Results of Location searches will be more accurate if you have enabled your mobile device to show your current location.

-

Can I use ATMs that are not Old National or Allpoint ATMs?

Yes. Your Old National ATM/debit card will work at all ATMs. However, doing so may result in several fees.

Surcharge fees

Out of network ATMs (ones that are neither Old National nor Allpoint) may assess you a surcharge fee. An ATM surcharge fee is the fee an owner of an ATM charges cardholders from other financial institutions who use their machine. In other words, if you have an Old National debit card and use it at another bank's ATM, that bank may assess a surcharge.Foreign fees

For most types of checking accounts, Old National will charge a $2.50 "foreign" ATM fee (on top of any ATM owner surcharge) if you use a non-Old National Bank or non-Allpoint ATM.To ensure fee-free ATM usage, we recommend always using an Old National or Allpoint ATM when possible. To find an Old National or Allpoint ATM, go to our website locator at oldnational.com/locations. Select the "ATM" and "Allpoint Surcharge-Free ATM" filters. You can also use the locator within our Mobile App to find both Old National and Allpoint ATMs.

-

What are financial scams I should be aware of?

What you need to know:

Scams fall into a couple of categories, Advanced Fee Scams & Bank and Financial Account Scams.- Advanced Fee Scams – based on the concept that the victim is promised a benefit (prize, lottery winnings, inheritance) but must pay in advance for some fee before the victim can receive that benefit. Variations of this scheme include business opportunity/work, credit card interest reduction, work from home online scams and romance schemes.

- Bank and Financial Account Scams – involve tricking individuals into providing their debit card, credit card or financial account information so that scammers gain unauthorized access to those account and siphon off funds. Some of these techniques include:

- Phishing – use of email and websites that pretend to be legitimate banks, financial institutions, credit card companies and manipulate the victim into disclosing personal and financial data

- Vishing – telephone equivalent of phishing; fraudsters call prospective victims and pretend to be the victim’s bank to trick them into disclosing details during the call

- SMiShing – texting equivalent to phishing

Types of Scams:

IRS Scams: Scammers call potential victims demanding cash payments for unpaid taxes via prepaid debit cards, money orders, Western Union/Money-gram or wire through their bank. According to the IRS, the agency will first contact taxpayers by mail, not by phone, concerning taxes owed and it will never as for payments using a prepaid debit card, money order or wire transfer.Online Dating Scams: Scammers troll media sites in search of romantic victims-usually claiming to be Americans traveling or working abroad. Here is how the scam works. You are contacted online by someone who appears interested in you. They may have a profile and email you pictures. For weeks, even months you may chat back and forth forming a connection. You may even be sent flowers or other gifts. Ultimately, your new “friend” will request money. There will be repeated hardships that only you can help alleviate. You may also be sent checks to cash or forward a package. In addition to losing your money, you may have unintentionally taken part in a money laundering scheme by cashing phony checks and sending the money overseas and by shipping stolen merchandise.

Grandparent Scam: A grandparent receives a call from a “grandchild”, typically late at night or early in the morning. The caller claims to be traveling out of the country and is in a bad situation (arrested for drugs, car accident, mugged) and needs money wired ASAP. The caller does not want his or her parents called. A variation is the caller claims to be an arresting police officer, lawyer or doctor and requesting money.

Online Shopping Scams: These can take many forms. Some scammers will pose as genuine sellers and post fake ads at much lower prices. After you pay, the items never arrive. Other scammers will pose as buyers and send a check for more than the required payment and ask for a refund. You send the refund and the check comes back as fraudulent. You are out the item and the amount of the refund.

What you need to do:

- Become familiar with common fraud scams

- Know who you are receiving checks from before you deposit them

- Never pay anyone to receive a deposit

- If someone calls you and attempts to obtain sensitive information or scam you, hang up

If you inadvertently provided personal information and feel your Old National accounts may be in jeopardy, please contact Client Care at 1-800-731-2265 Monday-Friday, 7am to 6pm or Saturday, 7am to noon CT.

-

What happens if my mortgage payment is scheduled to be paid from my account on a Sunday or holiday?

If a payment is scheduled to come from your account on a weekend/holiday, the payment will not be made until the next business day. To avoid late fees, you may need to adjust the date of your scheduled payment within Mortgage Manager.