Best Matches

How to Order (or Reorder) Checks

Order checks in several convenient ways: by phone, on the web, at a Banking Center, via Client Care, or through Online Banking (reorders only). Click to get started.

1,956 results found

-

Lump Sum or Not: What’s the Best Way to Invest Your Year-End Bonus?

Many corporate executives recently received their 2020 performance bonus. Others, especially at many large companies, will get them over the coming weeks. While the downturn in last year’s economy may have cut into these annual awards for some, others will receive tens, perhaps hundreds of thousands of dollars. So, whe

-

Merged, Separate, or Hybrid? The Ultimate Guide to Finances for Couples

Whether you’re striving to buy a home, pay off debt, or save for a secure retirement, your financial setup should support you, not burden you.

-

To Expand Or Not To Expand: Four Considerations For Growing Companies

-

To Raise Prices or Not to Raise Prices: Tariff Tips for Small Businesses

Tariffs have put businesses and the customers they serve in a bind.

-

When Choosing Joint Or Separate Bank Accounts, Here Are Some Key Considerations

Financial management is one of marriage’s most critical yet tricky parts. How you and your spouse handle money can significantly affect how you get along.

-

What are financial scams I should be aware of?

What you need to know:

Scams fall into a couple of categories, Advanced Fee Scams & Bank and Financial Account Scams.- Advanced Fee Scams – based on the concept that the victim is promised a benefit (prize, lottery winnings, inheritance) but must pay in advance for some fee before the victim can receive that benefit. Variations of this scheme include business opportunity/work, credit card interest reduction, work from home online scams and romance schemes.

- Bank and Financial Account Scams – involve tricking individuals into providing their debit card, credit card or financial account information so that scammers gain unauthorized access to those account and siphon off funds. Some of these techniques include:

- Phishing – use of email and websites that pretend to be legitimate banks, financial institutions, credit card companies and manipulate the victim into disclosing personal and financial data

- Vishing – telephone equivalent of phishing; fraudsters call prospective victims and pretend to be the victim’s bank to trick them into disclosing details during the call

- SMiShing – texting equivalent to phishing

Types of Scams:

IRS Scams: Scammers call potential victims demanding cash payments for unpaid taxes via prepaid debit cards, money orders, Western Union/Money-gram or wire through their bank. According to the IRS, the agency will first contact taxpayers by mail, not by phone, concerning taxes owed and it will never as for payments using a prepaid debit card, money order or wire transfer.Online Dating Scams: Scammers troll media sites in search of romantic victims-usually claiming to be Americans traveling or working abroad. Here is how the scam works. You are contacted online by someone who appears interested in you. They may have a profile and email you pictures. For weeks, even months you may chat back and forth forming a connection. You may even be sent flowers or other gifts. Ultimately, your new “friend” will request money. There will be repeated hardships that only you can help alleviate. You may also be sent checks to cash or forward a package. In addition to losing your money, you may have unintentionally taken part in a money laundering scheme by cashing phony checks and sending the money overseas and by shipping stolen merchandise.

Grandparent Scam: A grandparent receives a call from a “grandchild”, typically late at night or early in the morning. The caller claims to be traveling out of the country and is in a bad situation (arrested for drugs, car accident, mugged) and needs money wired ASAP. The caller does not want his or her parents called. A variation is the caller claims to be an arresting police officer, lawyer or doctor and requesting money.

Online Shopping Scams: These can take many forms. Some scammers will pose as genuine sellers and post fake ads at much lower prices. After you pay, the items never arrive. Other scammers will pose as buyers and send a check for more than the required payment and ask for a refund. You send the refund and the check comes back as fraudulent. You are out the item and the amount of the refund.

What you need to do:

- Become familiar with common fraud scams

- Know who you are receiving checks from before you deposit them

- Never pay anyone to receive a deposit

- If someone calls you and attempts to obtain sensitive information or scam you, hang up

If you inadvertently provided personal information and feel your Old National accounts may be in jeopardy, please contact Client Care at 1-800-731-2265 Monday-Friday, 7am to 6pm or Saturday, 7am to noon CT.

-

Where should I send a notice of error or request for information about my loan?

Please mail all notices of error or requests for information about your Old National loan to:

Old National Bank

Attn: Client Success

P.O. Box 143

Evansville, IN 47701 -

Why is my request for Digital Banking access showing as declined or pending?

When you complete the Digital Banking enrollment process, we must verify the information you provide in order to prevent any unauthorized access to your account. The security of client information is one of our highest priorities. If your request for Digital Banking has been declined, it most likely means we were not able to successfully verify the information you provided during the enrollment process. A pending status most likely means we are working to verify your information. We will email you to notify you when your Digital Banking enrollment request is approved or declined.

If you have questions or concerns about your Digital Banking enrollment, please call Client Care at 1-800-731-2265, and one of our associates would be happy to assist you.

-

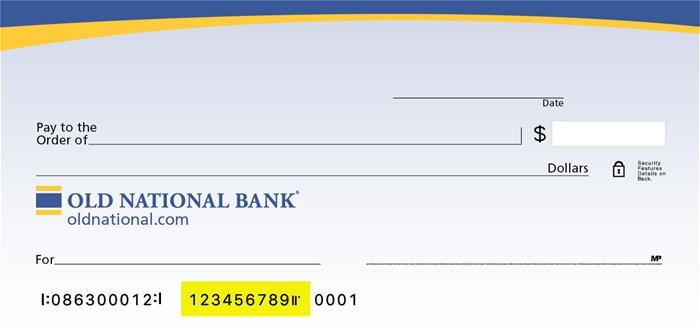

Where can I find my Old National checking or savings account number?

Within Online Banking, your full account number can be found through the following steps:

- After you log in to Online Banking, click on the account name for which you want an account number. Please remember that your account number will be different for each account.

- Clicking on the account name will take you to the Account History page. On this page, click on Account Details to reveal more information about your account. Your full account number is the ACH number.

- On the bottom right of the account details, you can print your account detail information or click the X to close the account details.

You can also find your full checking number in the following ways:

- On a mailed statement or eStatement within Online Banking. Your account number is on the upper right corner of the statement.

- At the bottom of a physical check or the bottom of a check image within Online Banking. You will see three sets of numbers at the bottom of the check. Your account number is the center set of 7-10 numbers. (Note that the set of numbers on the left, 086300012, is the Old National routing number.)

Visit any Old National banking center for assistance.

-

How do I change the address, phone number or email address on my account?

To change your mailing address, Old National offers several options:

- Please call 800-731-2265 Monday – Friday 7am to 6pm CST or on Saturday from 7am till noon CST.

- You may visit any Old National banking center and provide an updated photo ID or utility bill that contains the new address.

- Download a Personal Address Change Form or Business Address Change Form that you can mail to Old National.

To change your phone number or email address:

- Within Online Banking, go to My Settings and click Edit next to either your phone number or email address to update this information.

- You may also visit any Old National banking center or call Client Care at 1-800-731-2265.

Please note that changes can only be applied to the information for the person requesting the change. If there are additional people listed on the account, those individuals will need to request updates for their own information.